EMS Finance Directors: How to turn your E&O stock back into cash with our tailored In-Plant solution

Is your senior management team committed to driving down excess and obsolete inventory levels? Read on to find out how we can help as Kenny McGee, CEO of Component Sense, highlights how to turn your E&O stock back into cash.

Management awareness of the impacts of excess or obsolete (E&O) inventory is vital. Recently the US Supply Chain Resource Cooperative identified a number of characteristics associated with a properly developed excess and obsolete (E&O) inventory strategy published on 20 April 2018 in EPS News. The most obvious of which is....

E&O should be viewed as pure cash.

Source: Excess & Obsolete Inventory: Everybody's Responsible by Robert Handfield Ph.D .

Why E&O lacks attention in an EMS or CEM.

The initial problem with an EMS particularly, is that the E&O stock you hold is often ultimately owned by the customer. You cannot (and will not) sell it for less than cost otherwise you will make a loss. If you hold on to it long enough you will eventually be able to charge the full cost of that product back to your customer, often with a margin added on. This fact creates a tendency to pull in opposite direction and means that whilst you are motivated to reduce your inventory and increase the cash in your business the out come is usually one of paralysis and inaction.

We have been selling excess stock for OEMs successfully since 2001 and when we first started working for the big EMS companies in 2007 we came across the same barrier every time. Whilst EMS's were very motivated to reduce the E&O, they couldn't take a financial loss on stock whilst it was still technically active in their system.

This differs within an OEM business. As soon as an OEM knows the stock is obsolete to their requirements they are prepared to get rid of it quickly even if it means reducing the book value to achieve it. This makes logical sense in an OEM arena.

Our experience to date

When we are selling excess on someone’s behalf we usually need to undercut the market price to make the proposition attractive to the buyer. For us, market price is a price a mid sized ($100M revenue) company would pay for the stock. We also have to cover the marketing, distribution and warranty costs on anything we sell. Because most EMS companies of scale have superior buying power there is often scope to return at least 100% of cost whilst undercutting the market price.

e.g. If you imagine that you bought a product for $1 and the market price is $1.50 we may be able to sell it for $1.10 giving you your cash back whilst providing the buying company a reasonable discount as an incentive to break their existing supply chain. Our margin is small but because we adopt extremely lean processes and use technology and automation where possible we can cover the costs associated with selling your E&O.

Obstacles to good practice

-

We regularly receive lists from top tier EMS companies, for example a $50 million list of 1000's of E&O components. Initially we work with the list but find that we literally cannot move anything because the "standard cost" had all kinds of extras added (shipping, margin, storage costs etc) making it more expensive than market before we begin.

-

E&O stock in an EMS fluctuates constantly. You might have excess one day and none the next, then, the following day, loads of excess stock again. In-coming and outgoing stock can move so quickly in a volume business. By the time you cleanse and process your excess list the chances are that the stock has gone or been consumed by new forecasts. Your brokers invest huge amounts of effort to market and find a buyer for your stock only to find that the stock is no longer available when required.

-

Most EMS companies work with internal part numbers. Internal part numbers take little account for the manufacturer’s part number that is on the shelf. That creates a problem for us when we try to market the stock as we need to know the exact brand and part number that is available for sale. We often receive lists with 'possible' part numbers attached, detailing their most likely or last time bought brand. When we go to buy the item we discover that it was a different brand/part number or some other part from the approved vendor list (AVL). It is embarrassing for us as a re-seller as we have gone out and found a potential buyer, closed the deal, won an order and are then left in the difficult position of letting down a customer, which nobody likes to do.

Frustration causes bad practice

Ultimately what happens is an EMS company sends this list out to two, three, four, sometimes ten brokers. They typically struggle to sell anything because the communication is slow and understanding of each-others business is zero. You end up with many brokers marketing the same stock giving the impression of abundance in the market place. The brokers get tired of the merry-go-round and step off and little is achieved. You can imagine, if you are a broker and have been let down several times before you lose trust in the EMS supplier and become reluctant to promote their stock properly. All of our competitors are in the same situation. They often tell us, "we tried to work with xxxxx EMS company and it was a nightmare!"

The EMS enlists another group of eager brokers to send their list to with much anticipation and the process repeats. Frustration all round.

Insight into my experience

When I begin to assess a stock list for one of our clients I scan the market place for some sample part numbers from the list. I can quickly see who else is advertising the same stock. I can sometimes see up to 20 companies advertising a single part for an EMS company all with the same or similar quantities. This dramatically weakens the sale price and ultimately, your return. I know for a fact that none of these broker companies are putting their heart and soul into selling your stock for you because they know their is a high possibility that they are going to be let down in one form or another. They also have to contend with many other brokers fighting for the same sale. This drives down the margin to the point that it doesn't cover the costs. These brokers will often price the stock extremely high on the off chance that they will get away with it or they just do not quote it at all which is the most common scenario. The EMS company thinks that 20 companies are actively advertising their stock giving maximum exposure when in reality nobody is putting in the effort required to make a significant difference to your E&O sales. If you come to Component Sense with a list that is over exposed we will politely decline the opportunity unless you are ready to rewrite the script. I do not want to be one of 20 guys hitting my head off a brick wall and letting down my customers.

In truth most EMS customers use this process and believe it to work, to a fashion. It is my belief, that this model needs replaced because it just does not work. It frustrates everybody involved, including your team within the EMS company. You are creating these lists and sending them out to people and going through the motions. It becomes time consuming to take phone calls asking for part numbers and date codes from multiple brokers and ultimately generates little return for the business. Some brokers will make crazy offers if they know they have a potential sale. They will offer you 10%, maybe 20% if you are lucky, but as I stated at the beginning of the article, in the EMS arena that does not work because you will ultimately get your cash back from your customer.

EMS responsible E&O

When an EMS is deemed responsible for the problem causing the excess stock they are more likely to behave like an OEM and sell the stock at a slight loss however, most EMS companies are very good at protecting themselves from this with tight procedures and forecast buying. If properly protected contractually, it might take 6-18 months to get the cash from your customer but it is a "full dollar" return when you do!

The scenario described above is the main obstacle working with the EMS companies using the current processes you choose to employ. In the past, we were as poor as everybody else at serving the EMS market! It was frustrating and for a few years we stopped pursuing EMS companies' E&O stock all together. We are in the business of trying to impress our clients and we did not feel we could achieve this at the time.

"We never lost hope. We continued to visit EMS factories meeting people from a variety of departments trying to better understand their needs. There is a massive opportunity for you and us - just not using current systems and processes. I am a determined kind of guy and do not like to give up on something which I believe in and is lucrative for my clients."

Our bespoke solution

We have developed a solution that we feel, really makes a difference for E&O resale within an EMS plant, our InPlantTM system.

Internal part numbers

One of the biggest barriers to resale is the internal part numbers. Our InPlantTM system allows us to have somebody working within the plant (that could be an employee of ours or yours) and they collect all the data we need to efficiently and properly market your stock. We need live data. Our system is designed to take live data straight from your MRP system, whether it be SAP or another system, daily. We typically run reports over night so that we have new data each morning when we start. This speeds up the process for those collecting the stock data. It also allows us to track stock movements within your company. If a product goes out to production and back into stock we can monitor that and actually prevent a further stock check because we know it is the same part and date code. It can come back into stores without needing to be re-stock checked. These are some of the efficiencies we have added to our ever evolving system.

Costs

It is an extremely simple system that works on an iPad which we provide so there is no cost to the business. Because we are not physically buying stock until we have sold it, we can work on much lower margins than a traditional broker. Our goal is to give you at least 100% of your cost back and if you are buying well this is relatively easy to achieve. Wherever possible we will give you profit or positive price variance (PPV) on that stock as well. A large EMS will be buying well below the market price because of the volumes that you produce so we can buy it at full price plus a margin of perhaps 10% PPV and still sell it below the market price that a more modest size company would pay. This lets us sell stock that up until now, was unsaleable because of poor data and restrictive pricing.

Business Goals

During our visits to factories we meet with materials and purchasing people, senior management, operations and business unit managers. Essentially we meet with a whole spectrum of people to truly understand the business to enable us to create a tailored solution to their problems. We needed to know who all the stakeholders are and understand some of the limitations of existing processes. We also try to ensure everyone was on the same page in terms of goals and expected outcomes. For example the Materials Manager is focused on E&O so it is an easy sell to him and he is keen to reduce this figure as it is one of his KPI’s. Then you will find that the buyer is less keen to release the goods as they are more concerned with avoiding stock out situations.

"There is a saying in the business that a buyer would rather be looking at the stock than looking for it!"

Buyers would prefer to stockpile "just in case" rather than have to reorder it just in time (JIT) for a new forecast. Whereas an efficient just-in-time or a six sigma business holds only the stock that they need. If forecasts fall ideally you need to get rid of that stock as quickly as possible especially if you can get all of your money back. Nowadays there is no excuse for a company not acting quickly to reduce its stock holding. There are huge costs and risks associated with holding stock too long. You might find that your customer goes bust on you before you push the stock back and you could be left with millions of dollars of stock. Whilst you have got a contract that states that you can sell it back to them any number of things can happen and ultimately cost your business dear.

"Our InPlantTM system addresses all of these issues. The right time to reduce your stock is today and every day."

Trial Site

Back in 2012 on one of our EMS visits we met up with staff in a sizeable $2 billion revenue site. We faced all the same obstacles as before, but by this stage we had built version 1 of our InPlantTM system. We proposed a trial of our system and received the green light. At the time they were sitting on about $50 million excess stock across a number of business units. The InPlantTM system's particular goal was to collect good, live data and make the stock marketable. Our preparation was good and that side of it was quite straight forward.

The various business units had very different rules in terms of the contracts they had with their customers and suppliers so we had to accommodate that which added further complexity. Some BU's needed bigger margins than others.

Very large customers such as Blackberry and Nokia typically dictate to the EMS what the buy price is so cost is cost and there is no hidden margin, however, the buy prices are phenomenal which gives more PPV opportunity. Smaller customers do not usually have the buying power and rely on your (the EMS's) buying power instead. Many EMS companies make their money on materials.

Implementation stage

The implementation stage involved taking Version 1 of our system and working on site to perfect it. Initially we spent significant man hours testing, trialling, improving and tweaking this concept to turn it into a finished product. The time spent on site with multi functional teams allowed us to refine the process. The process improvement throughout, still continues to this day as we are always looking for efficiencies. We have a number of key metrics that we monitor constantly.

The number one metric being the value of the excess (percentage of the excess that is currently marketed. As there is a lot of stock moving in and out there is a fair amount of stock checking to be done. A typical 2 billion dollar site only needs one operator and many smaller plants can function well with one part-time operator. The operator does not have to be highly skilled to use our InPlantTM system. Therefore someone with basic warehouse experience is perfectly capable of running the system and help us to turn this stock back into cash.

Our live InPlantTM system today

Now we have a fully refined and tested product that is configurable to suit any EMS or any multi-site global business. We have since taken this product to very large OEMs and it is just as successful. Large OEMs often operate in a similar way to an EMS. They tend to have internal customers that are treated much like a business unit with tendering processes, QBR's and a full suite of service options.

"The full potential of our InPlantTM system is just beginning to be realised."

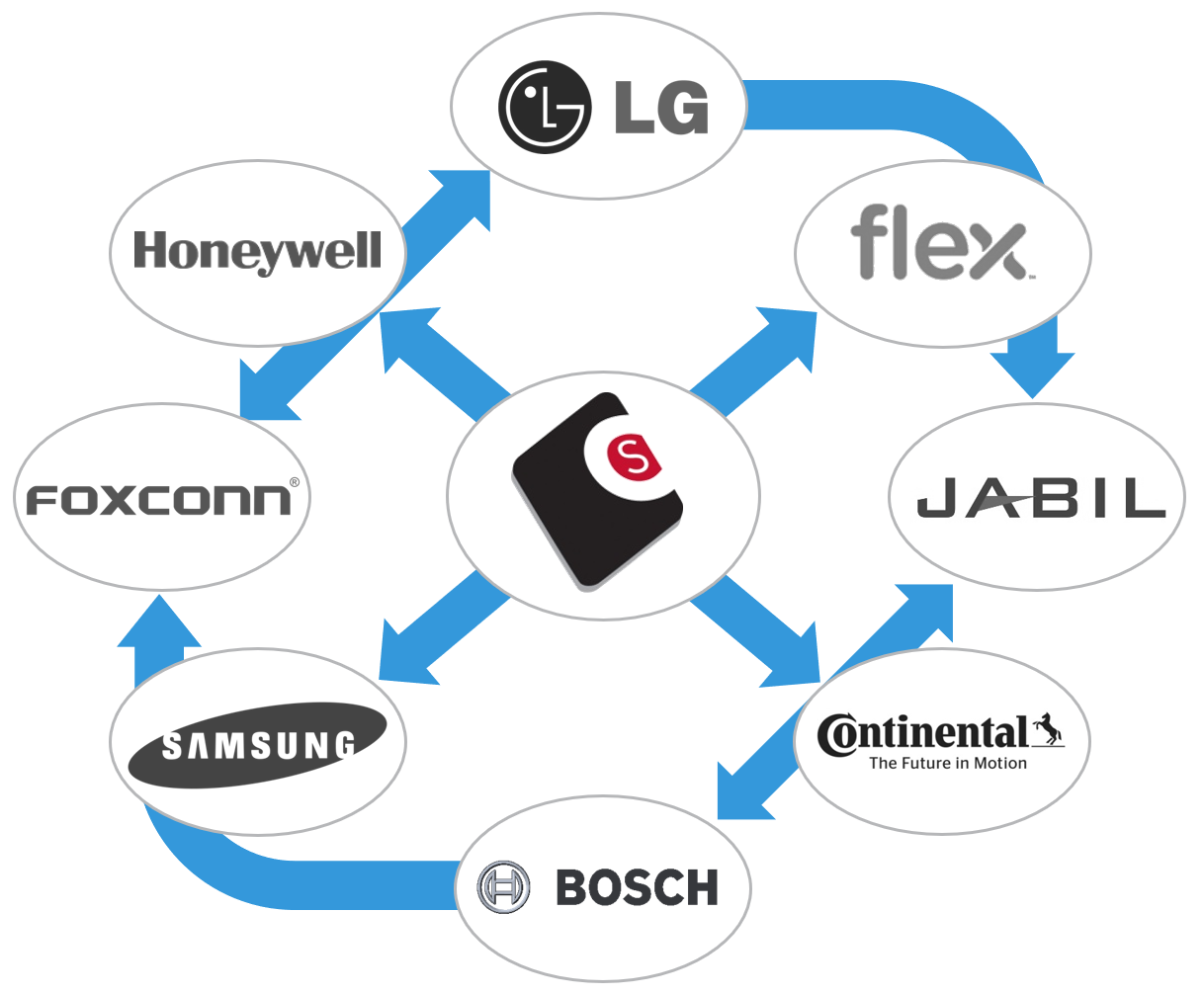

As we add more and more companies and factories into the InPlantTM system we are creating a superb network of trusted suppliers. Each EMS or OEM is a trusted supplier to us that has full traceability on its goods. Traceability is becoming increasingly important in all industries. We now manage hundreds of millions of dollars worth of fully traceable stock and can make it available to all of our clients. available to each other. Basically, we can act as the linchpin feeding stock, for example, from Jabil to Flextronics or Flextronics to Samsung or from Samsung to LG or Continental to Bosch and vice versa. When you do have a shortage situation this also gives you access to fully trusted, traceable stock.

Bespoke Solution

Our InPlantTM system is different for every site and we have customisation built in so that it can be adjusted to meet the particular needs of your plant. The system is designed to be delivered to multi-site companies. Even if you have slight differences in your processes and procedures across multiple plants, we can accommodate that easily. It is a very efficient tool.

Watch our video explaining our InPlantTM system in our blog post "Component Sense launch the ultimate inventory management tool".

Contact us today about our InPlantTM system allowing us to start selling your E&O stock and turn it back into cash.